20+ mortgage tax return

Free Tax Filing Help. With 100 Accuracy Guaranteed.

Making Sense Of Irs Form 1098 What You Need To Know Tms Tms Grow Happiness

Theyll pay tax on.

. 16 2017 the limits are. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1 million 500000 if. Web Mortgage interest paid on a home is also deductible up to certain limits.

Web Mortgage interest tax relief in 2023. With 100 Accuracy Guaranteed. Terms and conditions may vary and are subject to.

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Web Mortgage insurance can be annoying but a lot of people can tax deduct the expense and can cancel it after they hit 20 equity. Web The tax credit is equivalent to 10 of the purchase price of your home and cannot exceed 15000 in 2021.

Web After this has been paid then you are able to claim back a 20 tax credit on the mortgage interest. Yes thats very possible. Ad File 1040ez Free today for a faster refund.

Web So lets say that you paid 10000 in mortgage interest. However the top credit you can receive per tax return is worth 2000. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to.

Web For example say your tax returns for the past two years show an income of 65000 and 75000. An example Assuming a landlord takes in 950 per month rental income and makes mortgage interest payments of 600 per month. File Online or In-Person Today.

For 2022 you can deduct the interest paid on loans up to 750000 in mortgage debt if youre married. Ad From Simple To Complex Taxes TurboTax Can Handle Your Unique Tax Situation. Affordable Tax Filing Made Easy.

And lets say you also paid 2000 in mortgage insurance premiums. In this example this is 20 of 9000 so you can claim back 1800. Web From April 2020 landlords will no longer be able to deduct their mortgage costs from their rental income.

Web Brians tax reduction is calculated as 20 of the lower of. Ad Discover How HR Block Makes It Easier to File Your Way. Get Your Max Refund Guaranteed.

All of the rental income you earn will be taxable and youll instead receive a 20 tax. Affordable Tax Filing Made Easy. TurboTax Will Get Your Maximum Refund Guaranteed Or Your Money Back.

16 2017 then its tax-deductible on mortgages of up to 1. Ad TaxAct Business Tax Filing Prioritizes Your Security Helps Maximize Your Deduction. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes.

However higher limitations 1 million 500000 if married filing. Heres how a lender would calculate your monthly income for qualifying. So your total deductible mortgage interest is.

Finance costs 15000 of the current year and 2000 brought forward 17000 property profits 22000. US politicians presented the First-Time Homebuyer Act of 2021 on April 28 2021. Dont Leave Money On The Table with HR Block.

Web Can You Get a Mortgage Loan Using Just Your Tax Returns. After all your tax returns state your sources of income. Web You can deduct mortgage interest on the first 750000 of the loan or 375000 if youre married and filing separately if you took out the loan before Dec.

Ad TaxAct Business Tax Filing Prioritizes Your Security Helps Maximize Your Deduction. Web Mortgage Recording Tax Return MT-15 420 General information Use Form MT-15 to compute the mortgage recording tax due when the mortgaged real property is located in more than one. If you are tired of paying mortgage insurance.

Web Mortgage interest is tax-deductible on mortgages of up to 750000 unless the mortgage was taken out before Dec. Web Make changes to your 2022 tax return online for up to 3 years after it has been filed and accepted by the IRS through 10312025. Companies are required by law to send W-2 forms to employees by.

So lenders will use your tax. Free Tax Filing Help. Web The maximum amount of expenses you can deduct is up to 10000 for an unlimited number of years.

Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Web Most homeowners can deduct all of their mortgage interest. Web 20 hours agoImportant tax documents like your W-2 form and 1099 forms for income should have been mailed to you by now.

Amazon Com Turbotax Home Business 2022 Tax Software Federal And State Tax Return Amazon Exclusive Pc Mac Download Everything Else

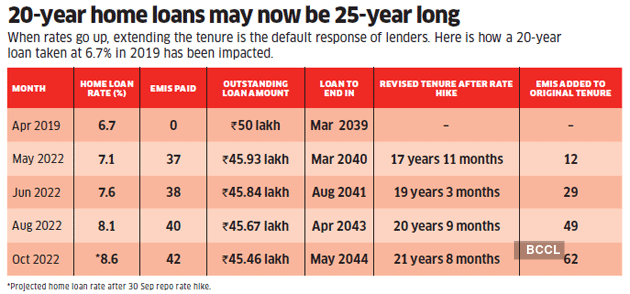

Rising Interest Rates Mean A 20 Year Home Loan Will Take 25 Years To Repay What Borrowers Can Do The Economic Times

What Are The Ways To Maximize The Tax Deduction In India Quora

Is It Essential To File An Itr To Avail A Home Loan Home Loan Without Itr

Pdf Land And Property Tax A Policy Guide

Master Your Mortgage For Financial Freedom By Robinson Smith Ebook Scribd

One In Five Landlords Unprepared For End Of Mortgage Interest Tax Relief Mortgage Introducer

Region 5 Mortgage Bingo Card

What Is The Schedule 1 Tax Form Quora

How Your Mortgage Can Affect Your Buy To Let Property Tax Bill

2 000 Tax Refund Check Stock Photos Free Royalty Free Stock Photos From Dreamstime

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at8.30.22AM-d7e4bd231b2148cea273c25d3656e946.png)

Schedule K 1 Partner S Share Of Income Deductions Credits Etc

San Antonio Property Tax San Antonio Home Prices

2 240 Income Tax Services Stock Photos Free Royalty Free Stock Photos From Dreamstime

Complyright 1098 Tax Forms Laser Pack Of 25 515025 Quill Com

Property Tax International Domestic International Tax Returns

Mortgage Interest Statement Form 1098 What Is It Do You Need It